An SDR-Linked Bond Can Strengthen the Finances of the World Bank Group

This is a joint post with Stephen Paduano.

An SDR-denominated, dollar, euro, yen, pound, or even yuan-settled bond issued by the World Bank wouldn’t directly provide what the World Bank needs most – new capital. With the Bank recently moving its minimum leverage ratio to 19 percent, a dollar in true capital at the International Bank for Reconstruction and Development (IBRD) can support approximately 5 dollars in assets. That’s the minimum. There is scope – with new funding structures – to stretch the Bank’s capital a bit more.

More on:

But most of the world’s SDRs aren’t available to invest in instruments that would count as capital. Many countries effectively are required to use budget resources to provide the multilateral development banks (MDBs) with capital. Reserve assets are invested in safe, highly rated bonds, not in paid-in capital or even hybrid instruments. As most countries treat the SDRs they have received from the IMF as part of their reserves, the bulk of the world’s SDRs can only be invested in clean reserve assets. Dollar- and euro-denominated bonds issued by the World Bank are one such asset; there is no good reason why an SDR-denominated, dollar- or euro-settled bond should not be viewed as one as well.

While not capital, a funding model that included significant SDR bond issuance offers significant financial advantages for the MDBs – advantages that we want to highlight here.

The current pool of SDRs is effectively trapped in accounts at the IMF – the SDRs held by the U.S., the eurozone countries, the UK, and Japan cannot easily be converted into liquid foreign currency.* Any SDR-denominated, cash-settled bond thus is an improvement in the functional liquidity of the SDR balances held by the world’s major advanced economies. Trapped SDRs would be invested in a bond that could, if needed, be sold into the global market for dollar, euro, or yen bonds. The World Bank has the legal authority to receive their SDRs and could enter the SDR’s Voluntary Trading Arrangements (VTAs), turning SDRs into hard currency to support its lending operations, subject to the VTA’s having sufficient liquidity to convert such volumes. **

In return for providing this service – the kind of classic financial intermediation that the development banks are designed to provide – the World Bank would be able to obtain significantly long-term financing. Say 30 years. SDR-denominated bonds need to carry a floating rate but should carry tenors that match the Bank’s long-term lending. That’s the big advantage of tapping this currently trapped pool of funds: it would allow the Bank to obtain very long-term funding that matches its very long-term lending.

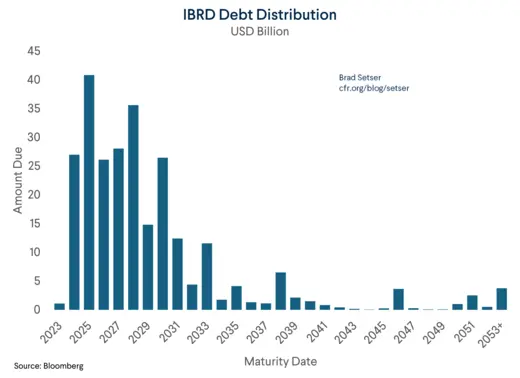

A funding model with a large quantity of 30-year bonds would be a significant shift for the World Bank. The World Bank’s Treasury currently finds the readiest market for its bonds in the 5-to-10-year maturities. It does issue at longer tenors, but in limited quantities. The average maturity of the bond portfolio of the International Bank for Reconstruction and Development (IBRD) is just under 6 years, and well over half of the outstanding stock matures and will be replaced over the next five years (the IBRD is the heart of the World Bank group; it does the Bank’s non-concessional lending). Over the last few years, IBRD has lengthened the maturity of issuance compared to previous years. For example, IBRD issued bonds with an average tenor of between 7 and 9 years in the last three fiscal years. Nevertheless, the maturity extension possible with a well-designed SDR bond issuance program supported by the key shareholders would be substantial.

More on:

We think these financial advantages would enable the World Bank to stretch its existing balance sheet: a safer, longer term, less expensive funding structure could enable existing IBRD equity to support a bit more lending, and also help the International Development Association (IDA) match its long-term assets better, thereby releasing some of the capital being held against interest rate risk. But these structures really gain power when combined with new equity and the Bank’s proposed hybrid capital facility would enable donors/investors to earmark (the World Bank calls it ‘preferencing’) new equity for specific purposes, such as expanding climate financing.

Extending the Duration of the IBRD’s Balance Sheet

The IBRD does the bulk of the total borrowing of the World Bank Group. It currently has about $255 billion of outstanding bonds with an average maturity of about 6 years. As is often the case, the average maturity is increased substantially by a few 20- and 30-year bonds – over 50 percent of the IBRD’s issuance comes due in the next five years. As a result, the IBRD needs to maintain a substantial liquidity buffer – currently in the $50-60 billion range.

Scaling up the Bank’s balance sheet – whether by stretching the existing capital a bit more, increasing the Bank’s equity base, or a mix of the two – with the Bank’s existing funding model would require increasing the liquidity buffer.

This actually has a cost. The Bank’s Treasury believes it can maintain a liquidity buffer of its current size at no net cost to the Bank (or even at a slight profit), but any substantial increase in the size of the liquidity buffer might yield reduced or negative returns. That ultimately cuts into the Bank’s capital, as returns on the Bank’s investment have been an important source of equity (the IBRD has about $60 billion in equity now, including its current $22 billion of paid-in capital).

30-year bonds would enable balance sheet expansion without increasing the liquidity buffer – or could even allow a reduction in the liquidity buffer if they substitute for a portion of current issuance. The holders of SDRs should be willing to buy 30-year SDR bonds at par so long as they pay the SDR (floating) rate – the only alternative to the World Bank’s bond is the IMF’s SDR account, which (for advanced economies) is functionally illiquid.

Such a funding structure, if paired for example with the new hybrid capital instrument, would enable a substantial increase in the bank’s climate financing without putting any pressure on its current funding model. It equally could be paired with new hybrid capital to support an increase in the Bank’s lending to fragile and conflict prone states – of which there are now many.

Strengthening IDA’s Balance Sheet

IDA, the World Bank’s concessional lending arm for low-income countries, faces real challenges raising the funds it has already promised to help stretch donor contributions.

A bit of background here: IDA historically did not use any leverage. Its entire concessional loan portfolio was funded out of accumulated donor equity. This had advantages for IDA’s balance sheet: donor equity doesn’t come with a fixed interest cost, and thus was a perfect match for very concessional (even zero rate) long-term loans. But it also means that IDA lending is very “budget intensive” for IDA’s donors – the repayment of existing IDA loans allows a certain amount of new lending but expanding the stock of IDA lending through this model required about as many budget dollars or euros as making grants.

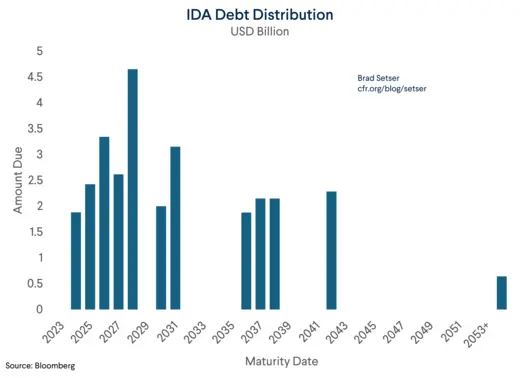

To supplement its $185 billion in equity, IDA adopted a “hybrid financing model” in 2018. The idea was simple: to issue a few bonds on top of the large equity base to ensure IDA has liquidity available to support future commitments. But it needs low rates, as its loans are on very concessional terms. Shareholder transfers, together with the transfer of any excess income (“loan reflows”) from the IBRD and unspent funds from prior IDA replenishments (“carry over”), have to be sufficient to cover IDA’s interest expenses.

To date, IDA has issued close to $30 billion in bonds with an average maturity of around 8 years at a low average coupon of 1.41 percent. $30 billion of low-cost bonds and $185 billion of zero-cost equity resulted in a low blended funding cost, so the extra leverage in the hybrid funding model hasn’t been that costly. But half of the $30 billion in current bonds outstanding are coming due in the next five years and could need to be refinanced at much higher rates (5-year bonds pay around 2 percent, 5-year Treasuries pay around 4 percent).

Moreover, as IDA’s 20th replenishment is the largest in the history of the Bank, the market borrowing used to support it must be the largest as well. In order to achieve the $93 billion replenishment envisioned by IDA20, IDA will bring in $23.5 billion in shareholder contributions, $11 billion in carry over from IDA19, $30 billion from loan repayments and the Multilateral Debt Relief Initiative (MDRI), and $800 million in net income transfers from IBRD — which leaves around $30 billion that needs to be raised by new debt issuance.

Raising these funds at a reasonable cost now looks challenging. IDA didn’t issue for over a year, between August 2022 to October 2023, because it didn’t need the liquidity. And IDA’s borrowing costs notably increased once it resumed issuance, because the market interest rates had risen in the interim. Against an average coupon of 1.26 percent, it raised a £800 million for 8-years at 4.75 percent, a $2.5 billion for 5-year at 4.88 percent, NOK 3 billion ($276m) for 5-year at the 3 month NIBOR + 19bps (currently 4.86 percent) and a €600 million for 30-year at 3.8 percent. IDA is AAA-rated and has an enviable balance sheet, but all these bonds are priced at a premium over the benchmark risk-free rates in the issuing currency. Recent sterling and dollar issuances have both come at a 70 basis point premium to their risk-free rates. When IDA begins to issue debt to directly fund its lending (currently IDA is still transitioning to leveraging its lending), these cost differentials will mean a draw on IDA resources.

The problem for IDA isn’t that it can’t raise the funds. The problem is that its borrowing costs have risen, and those borrowing costs must be offset by donor contributions and internal resources for IDA to lend at zero or near-zero rates. Moreover, holding its funding costs down historically has required IDA to run a bit of a maturity mismatch – its recent 30-year euro-denominated issue is commendable, but the core market for its bonds is for 5-to-7-year instruments. The current weighted average maturity for IDA’s $30 billion in market debt is around 8 years. That’s a problem because it often lends for 40 or even 50 years. This is why the IDA20 replenishment plan called for a “lengthening of the maturity of IDA’s market borrowing… given the long duration of IDA’s fixed-rate loan assets.”

Right now, IDA’s market borrowing essentially funds IDA’s liquidity buffer. But in the next few years IDA’s borrowing is expected to directly support IDA lending, making it even more important to lock in long-term funding support to match its long-term lending.

An SDR-denominated, dollar, euro or yen-settled bond offers the most viable strategy for helping IDA achieve its fund-raising goals while also addressing the asset-liability mismatch that World Bank President Ajay Banga highlighted in a Reuters interview back in June.

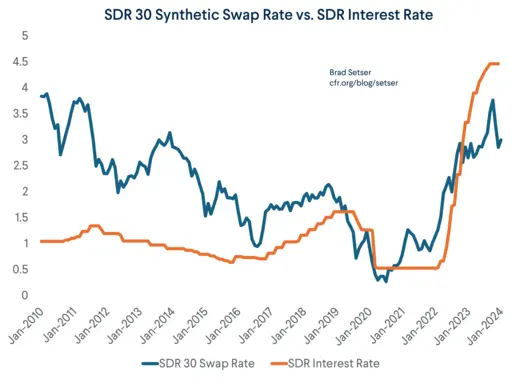

An SDR bond would likely carry a floating rate. But IDA tends to lend at a fixed rate, so the Bank’s Treasury would need to set aside a tiny bit of capital to support a program of swapping the SDRs floating rate payment structure into a fixed-rate instrument using standard swaps for the key constituent currencies. As the yield curve is currently inverted, we estimate that a floating rate SDR bond swapped back to a fixed rate (or fixed rate SDR bond issue) using the swap curves for its constituent currencies would generate 30-year funds at a fixed rate of around 3 percent. An SDR bond issuance thus could generate a nearly unlimited supply of 30-year funding at a fixed rate of around 3 percent – see the chart, at many times in the past the rate would be lower – something the World Bank currently lacks.***

There’s an added benefit for IDA’s balance sheet: an SDR bond makes sense for IDA in particular, as its base currency is the SDR. 83 percent of IDA’s loans outstanding are denominated in SDRs. Yet other than its concessional partner loans (less than 20 percent of its liabilities), IDA has no liabilities denominated in SDRs. IDA is considering shifting its currency of denomination away from the SDR to reduce its currency hedging costs – and the advantages of an SDR bond aren’t dependent on lending in SDR – but so long as IDA operates in SDR, raising funds in SDR would also help IDA limit its currency risk.

Private capital markets will not provide long-term fixed rate funding at comparable rates – the existing market for 30-year IBRD and IDA paper is limited, and raising the money requires paying a premium over the risk-free rate. An SDR bond is thus really a win-win-win: IDA would get low-cost, long-term funding that wouldn’t cannibalize the existing market for long-term IBRD funding; holders of SDRs would continue to receive the SDR rate on their SDR reserve assets while increasing the functional liquidity of their SDR reserves (as an SDR-denominated, dollar- or euro-settled bond can be sold if needed in the private market, it doesn’t rely on the VTA for liquidity); and low-income countries would receive increased access to concessional funding.

Sustaining, and even expanding, IDA is more important than ever. For most low-income countries, other financing options have essentially dried up. The bond market is not open to new “frontier” issuers, and many established borrowers currently cannot refinance their maturing bonds. This much has been made clear by the fact that no African country has been able to issue a Eurobond for over a year.

In addition, China’s Belt & Road lending has been at a standstill since 2020 as Chinese policy lenders have cut back dramatically (World Bank International Debt Statistics has the details). That’s proving to be particularly problematic as the interest rate on existing LIBOR-linked loans has ratcheted up and old loans have started to amortize. What lending Chinese policy backs now do is mostly defensive – seeking to encourage the repayment of existing exposures.

With bond markets closed and Chinese capital off the table, for most low-income countries MDBs are the only financially viable source of external funding.

No Other Place to Go

IMF members have now pledged to rechannel $108.15 billion in SDRs, yet the conventional ways of rechanneling — through the IMF’s Poverty Reduction & Growth Trust (PRGT) and Resilience & Sustainability Trust (RST) — can only take in at most $61 billion in SDRs. The IMF’s PRGT can’t take in more SDRs unless it receives more subsidy resources (budget dollars) from the IMF’s members. Alternatively, the PRGT could be funded by selling a small portion of the IMF’s $186 billion in gold, if Congress agrees to it, in which case it would have no need for additional resources. The IMF’s RST is struggling to make use of the SDRs that have already been pledged — of the $41 billion raised, only $819 million (2 percent) has actually been disbursed, though a few more loans are in the pipeline.

This leaves about $50 billion of already pledged SDRs with no place to go. And the surplus of already pledged SDRs is just the start. There are many more SDRs that could be pledged – the U.S., for example, has $166 billion in unpledged SDRs now sitting idle in the Exchange Stabilization Fund’s SDR account at the IMF.

The case for opening a second channel for SDR rechanneling is thus compelling. The MDBs are actually better positioned to transform SDR reserves into long-term development financing, as, well, that’s the purpose of bond-funded development banks. They sell bonds that provide the holders with the liquidity intrinsic in a marketable instrument and they use those proceeds to fund long-term loans. There is literally no simpler way of preserving the SDR’s status as a reserve asset than investing them in SDR-linked bonds.****

*All these countries — the U.S., UK, Japan, and eurozone countries — are in fact currently expected to be buyers of SDRs in the IMF’s voluntary trading window, and thus suppliers of liquidity.

** Increasing the use of SDRs will require addressing the illiquidity of the Voluntary Trading Arrangements. In the near term, this can be done by having the Federal Reserve purchase SDR certificates from the U.S. Treasury’s Exchange Stabilization Fund (ESF), thereby supplying more dollars for the ESF to be the counterparty in more purchases of SDRs (i.e. pumping more liquidity into VTAs). But over time, a smarter and more effective SDR system would be one in which there is a strong expectation that the SDR department will queue countries for SDR purchases if they hold more reserves than needed for precautionary reasons – and that any country, including centers of global tax avoidance, that shifts reserves over to sovereign wealth funds should be the primary providers of liquidity (buyers of SDRs) in the VTAs. With $12 trillion in reserves, there should be no shortage of “buyers” for the volume of SDRs that realistically can be mobilized through an SDR-denominated bond.

*** The Bank is one of the bigger players in the swaps market; the Bank Treasury famously pioneered swaps in a 1981 deal with IBM – the World Bank swapped its dollars for IBM’s Deutsche mark and Swiss francs.

**** The ECB cites European Council Regulation EC3603/93 Article 7 in requiring that Eurosystem SDRs maintain their status as a reserve asset and not be used for “monetary financing.” This regulation proactively carves out funds shifted to the IMF from the monetary financing test but doesn’t preclude the possibility that other uses of SDRs would also meet the test. This has set up a problem for some proposals for how to make use of SDRs, however an SDR bond would not run into this issue. An SDR bond is clearly a reserve asset – it literally is the same instrument as the dollar and euro MDB bonds that many countries now hold in their reserves. A reserve manager that invests dollars on deposit at, say, the Federal Reserve in a World Bank bond isn’t considered to be violating the prohibition on monetary financing; it simply is investing its reserves in a traditional reserve asset that offers a good combination of yield, liquidity, and safety. Indeed Eurosystem national central banks report doing this regularly – and filings of the World Bank demonstrate that roughly 50 percent of World Bank bonds are held by central banks and other monetary authorities – and the ECB does not police the denomination of such purchases. Whether a Eurosystem national central bank buys an MDB bond denominated in euros, dollars, or SDRs is not relevant to the ECB. SDR-denominated, FX-settled bonds actually serve a specific reserve management need, as they raise the effective liquidity of advanced economies’ SDR reserve balances by freeing the SDRs from the constraints of the IMF’s voluntary trading arrangement. We thus expect the ECB to conclude that shifting SDRs out of the IMF account into an SDR-linked MDB senior bond issue is analogous to investing dollar balances in a dollar bond issued by a multilateral development bank and thus fully consistent with ECB guidance on the use of Eurosystem reserves.

Online Store

Online Store